The intersection of AI and crypto: creating efficient economic systems

The Intersection of Artificial Intelligence and Cryptography: Creating Efficient Economic Systems

The growing use of artificial intelligence (AI) across various industries has sparked growing interest in financial applications, especially in cryptocurrency markets. Traditional economic systems rely on the value of currency as a medium of exchange, but with the emergence of cryptocurrencies such as Bitcoin, blockchain technology is gaining ground as a viable alternative. In this article, we will examine the intersection of artificial intelligence and cryptography and discuss how these two technologies can create efficient economic systems.

The Rise of Cryptocurrencies

Cryptocurrencies have become popular over the past decade due to their decentralized nature, peer-to-peer transactions, and limited supply. Launched in 2009, Bitcoin is one of the first and most well-known cryptocurrencies, followed by other altcoins such as Ethereum, Litecoin, and Ripple. The widespread adoption of cryptocurrencies has disrupted traditional financial systems and forced banks and governments to adapt to new market dynamics.

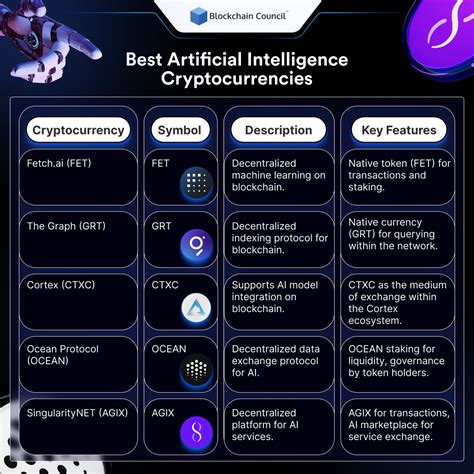

Artificial Intelligence in Cryptocurrency

AI has been integrated into various aspects of cryptocurrency markets, including:

- Predictive Analytics: AI algorithms can analyze large data sets from exchanges to provide real-time predictions about price movements, trading volumes, and market trends.

- Trading Strategy Development: AI-driven tools can create personalized trading strategies based on historical data, risk management techniques, and algorithmic trading models.

- Risk Management

: AI-driven systems can detect anomalies in market activity, identify potential risks, and adjust positions accordingly.

- Security: Security measures enhanced by AI can detect and prevent hacking attempts, ensuring the integrity of cryptocurrency transactions.

Efficient Economic Systems

The integration of AI into cryptocurrency markets has led to a number of efficient economic systems:

- Decentralized Finance (DeFi): Blockchain-based DeFi platforms enable peer-to-peer lending, borrowing, and trading without intermediaries, reducing fees and increasing transparency.

- Automated Trading: AI-driven trading bots can execute trades at optimal times, minimizing slippage and maximizing profits.

- Smart Contracts: Self-executing contracts, in which the terms of the contract are written directly into lines of code, ensure secure, transparent, and efficient transactions.

- Regulatory Compliance: AI-powered systems can help regulators identify potential regulatory risks, allowing them to develop more effective policies.

Challenges and Opportunities

While integrating AI into cryptocurrency markets presents several challenges:

- Interoperability: Integrating different blockchain platforms and wallets is becoming increasingly complex due to differing standards.

- Regulatory Uncertainty: Governments continue to struggle with how to regulate AI-powered cryptocurrencies, leading to uncertainty and potential market volatility.

- Cybersecurity Risks: AI-powered systems can be vulnerable to hacking attempts that could compromise the integrity of cryptocurrency transactions.

However, these challenges also present opportunities for innovation:

- Enhanced Security: Security measures enhanced by AI can help protect against cyber threats and reduce the risk of fraudulent activities.

- Increased Efficiency

: Optimized trading strategies and automated processes can lead to increased efficiency in market activity.

- Enhanced Transparency: Blockchain-based DeFi platforms provide real-time visibility into market activity, enabling more informed decision-making.

Conclusion

The intersection of AI and cryptography has led to the emergence of efficient economic systems that could revolutionize traditional financial markets.